Is SaaS subscription and viable for mobile app pricing strategy?

Introduction

We live in a surreal technology world. Developers focus on apps aiming to market them through The App Stores or Google Play. In contrast, others are active in the SaaS arena. When customers looking at software as a service decide that a product is suitable for their business, they will gladly subscribe for around $40 per month on autopay. However, for an App developer to earn even 50% of that is a tall order, as we’ll see.

The competitive app environment leans toward free downloads in most new app situations (even long-standing ones). Therefore, most of an app’s value proposition occurs after the download, when the user begins to appreciate the numerous benefits. Thus, app success depends on in-app purchases, transitioning from basic (free) to premium (where a subscription is essential), and other feature access, requiring user spending. As a result, predictability is iffy, and pricing optimization is frequently an elusive concept.

Customer behavior patterns: SaaS users vs. Average app users

Immediately we see significant differences between a SaaS and app users:

- When Saas buyers enter the user circle, it’s after considerable consideration and carries with it a staunch commitment. Therefore, versus the typical app, expect:

- Much fewer downloads.

- Substantially longer subscriptions per customer paying monthly fees.

- App customers, because the download is free (or next to nothing – perhaps $0.99), download prolifically. However, the commitment level is startlingly low (relative to SaaS), as demonstrated by a 95% rate churn over time (i.e., deleting the download, using it little or not at all).

- The balancing factor is that apps probably enjoy ten times more downloads than SaaS. Otherwise, it would never pay (more on this below). Another way of looking at it is that an App needs to usher in droves of downloads to equal one committed SaaS customer.

A case study

Apples to apples, the app customer that becomes brand loyal may contribute less or more than the SaaS subscription fee over the number of months they use it. It brings us to a critical metric – Lifetime Value (LTV). There are a few ways to calculate this. We find the most practical way is as follows, keeping the SaaS and app comparison front and center of our focus:

- Assume 100 customer downloads for both the SaaS and app examples.

- Determine ARPU (the Average Revenue Per User for the 100 as long as they stay committed.)

- For Apps: Let’s say it’s $20 monthly derived from subscriptions and in-app purchases.

- While active, let’s assume the SaaS user subscribes to a $40 monthly fee – twice the app number.

- Next, predict the maximum brand loyalty period and the most significant app fan sustainability. Let’s call it 22 months for the app and SaaS.

- While the SaaS example above, aside from the $40 average monthly usage value (2 X the app), also carries a low churn factor (say 8% or 92% retention), reflecting robust commitment.

- Now for the hardest pill to swallow – the app churn rate: The observed decay is significantly more destructive. Let’s call it 95% churn over the 22 months or 5% retention (signaling low commitment on entering).

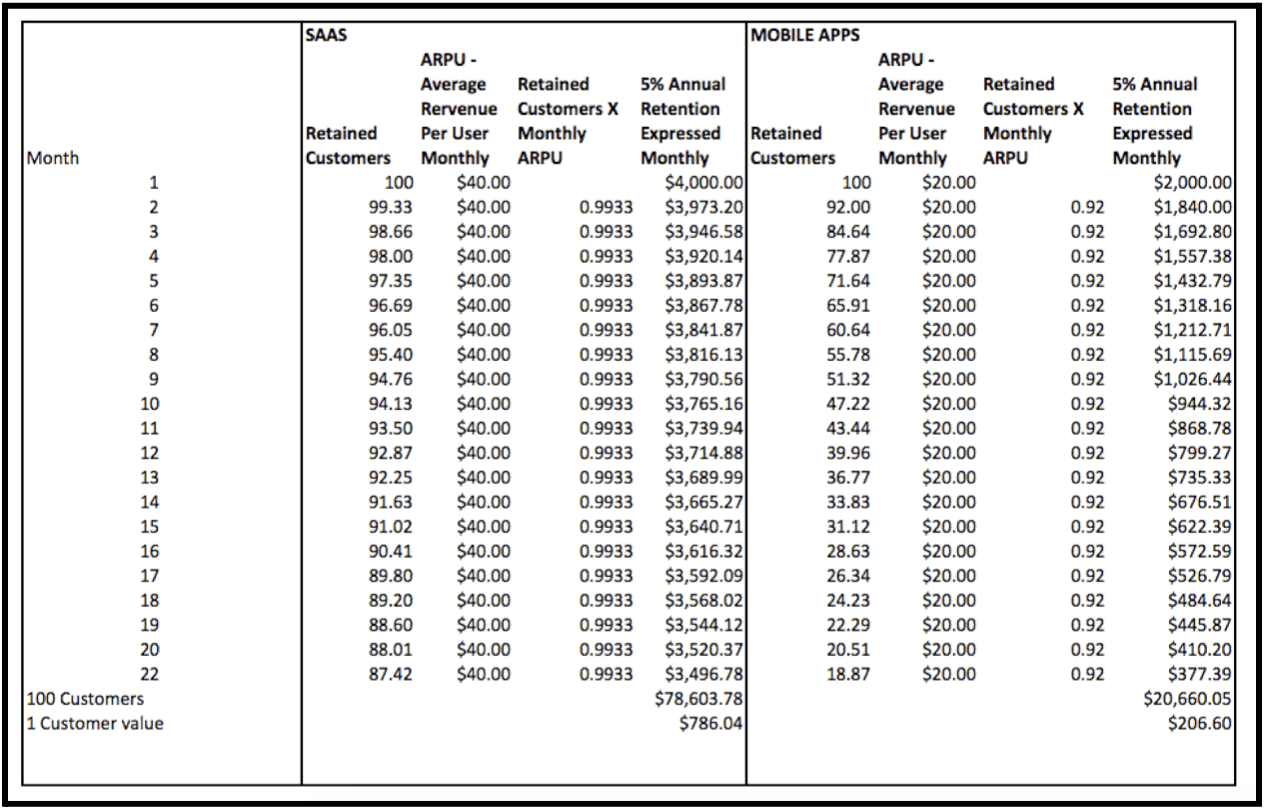

Look at the table below:

TABLE 1

SaaS

- We can see that 87 of the 100 users stayed brand loyal for the maximum 22 months customer life cycle.

- Note: We applied the 8% annual churn extrapolating it to 0.67% monthly against the ARPU of $40 per month.

- On average, the LTV of one customer based on the original hundred is $786.

App

- We can see that only 19 of the 100 users stayed brand loyal for the maximum 22 months customer life cycle.

- Note: We applied the 95% annual churn extrapolating it to 8% monthly against the ARPU of $20 per month.

- On average, the LTV of one customer from the original hundred is $206.

The decay pattern in the chart is probably more realistic for a SaaS product, while the churn is far quicker in the first six months and then levels off for an app. It won’t make much of a difference, but to be conservative, let’s assume it deflates the average App LTV by another 15% down to $185.

How realistic is the scenario above?

- A 2015 survey conducted by Pacific Crest measured SaaS customer churn at 8% annually. Conversely, these products enjoyed a 92% user retention.

- On the other hand, apps could only eke out a 5% retention, losing 95% of first-time customers to churn.

Now, you can argue that things may have changed over the last few years, but ask anyone in the business, and they’ll admit it doesn’t feel like it. App marketers tell us that getting the right customers through the door, ready to make a brand commitment, is an uphill battle. Therefore, If you are an experienced app developer, we’re sure you’ll agree with our visualization above, as being pretty close to reality. Let’s dig a little deeper to see why.

Customer retention and CAC (Customer Acquisition Cost)

Apps, like anything else in the tech environment, are no gimmicks. Investments before launch range from $30,000 to $300,000, and that’s only the start. Hot on the heels comes the brand launch with a significant budget allocated to sophisticated marketing on many levels. So, when we glibly refer to an app, we’re talking about a full-blown business with a team working behind it. All of it comes to nothing unless you can achieve baseline customer retention.

Why is user retention so vital?

Because it costs much less to maintain a brand-loyal user than it does to get them on to the customer list. If a customer falls off the bandwagon quickly, advertising spending and ASO planning go down the drain. So it doesn’t matter whether you’re a SaaS or app business; to ROI, churn is the enemy, and retention is the friend.

SaaS retention rates outstrip the app industry by miles. But then, the number of initial downloads for an app substantially exceeds SaaS. So, what does all this tell us about app store optimization pricing and net profitability? It all boils down to CAC.

What is CAC, and what’s its impact on app pricing optimization?

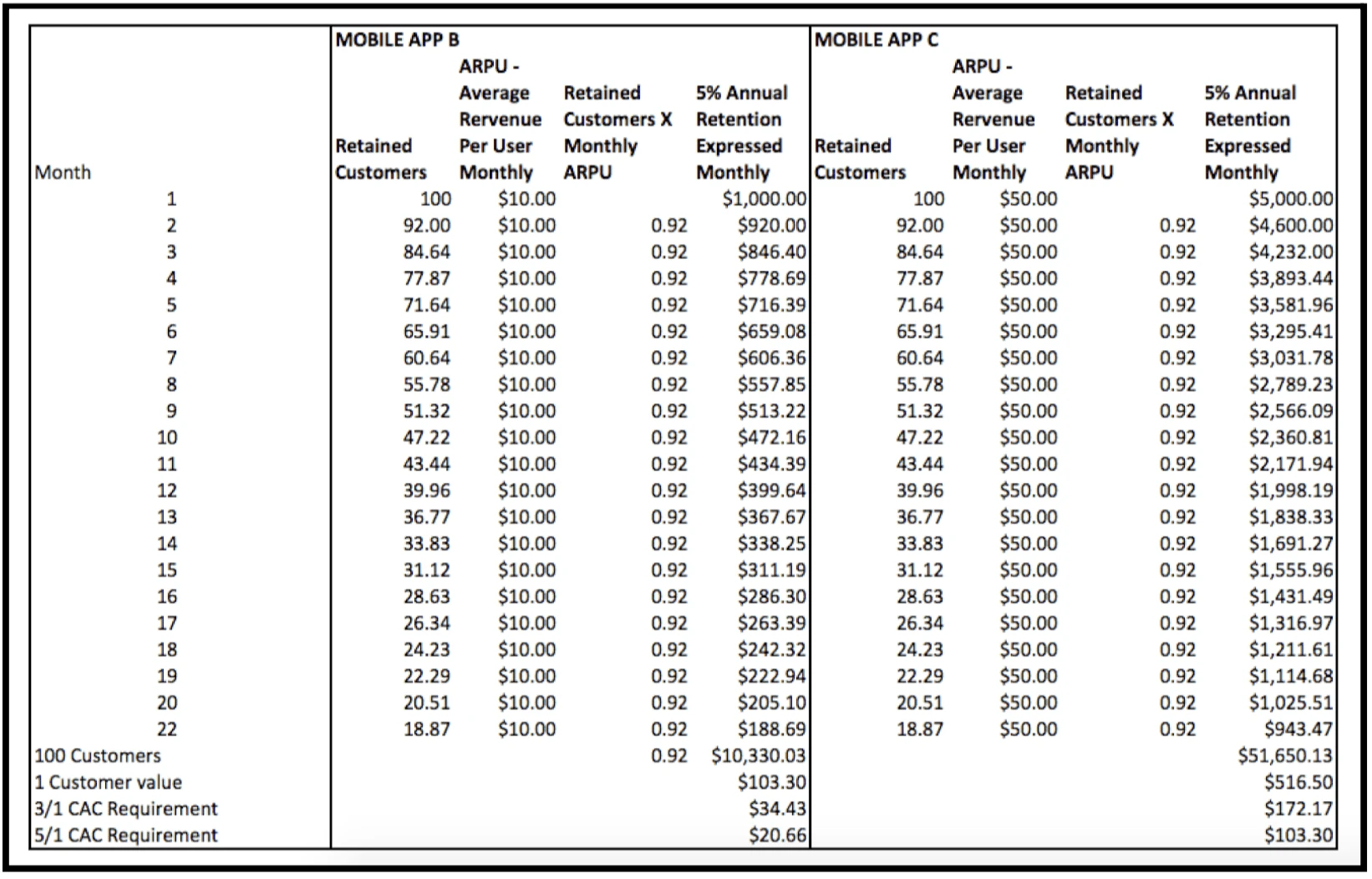

A primary metric emerging in both the SaaS and app industries is Customer Acquisition Cost (CAC). Pundits in both industries cite a traditional yardstick of Lifetime Value (LTV)/(CAC) at 3/1 to ensure success. Some app experts believe a 5/1 ratio is more applicable to their arena. So, in our case study above:

- The average CAC for SaaS should be average customer LTV/3 = $786/3 = $262

- The average CAC for the average app should be LTV (adjusted)/3, ranging to LTV (adjusted)/5

- $185/3 = $62

- Ranging to $185/5 = $37.

If you find that your monthly ARPU is lower or higher, substitute it. So, for example, an app with $10 or $50 monthly ARPU will generate numbers, as shown in Table 2 below. It pushes the CAC down or up by the divider or multiplier of the monthly ARPU in Table 1 above.

TABLE 2

Be brutally honest with yourself.

The buying behavior of SaaS and app users are significantly different from one another, no doubt about it.

- The task of a SaaS marketer is to drive customers from attention to conviction before downloading, trusting that the subscription power will hold firm for an extended time.

- Essentially, it depends on a compelling presentation that swings the users into the brand-loyalty arena even before the downloads occur.

- In other words, once downloaded, the users continue with the mindset to stay with the technology long-term.

- Of course, the downloads have come from committed users who have put their money where their conviction lies. In other words, It’s far more than a casually engaged audience that often enters for free in the app markets.

- Conversely, app marketers seem more focused on getting enough interest (call it half-interested, if you will) to initiate a download.

- They rely on in-app promotion and actual usage to pull the user into monetization, hoping for more commitment.

- Indeed, the hope is that the after-download retention will be enough to warrant the CAC despite massive churn. We expect many more downloads in this situation but thin retention before any loyalty establishes itself.

At this point, looking at your own numbers – whether a SaaS or an app developer – you should be relating to this. If, for example, you’re in the app camp with ARPUs similar to our app examples, but your CAC is up there with the SaaS example, the business is in serious trouble. At the very least, you have to have an LTV/CAC of 1/1 = breakeven. Developers who show ratios of less than one are indeed leaking cash flow.

Can I learn anything from SaaS pricing to improve customer retention?

Everything from the narrative above indicates that SaaS developers and app entrepreneurs have significantly different perspectives when they get into marketing. Of course, much of this is a natural result of trends in the industry. However, the one that hits home the hardest is that mobile app users kick off their customer journey (CJ) with a lower perceived value than SaaS customers. Why?

The SaaS model aims at an audience looking to address an endemic business problem, streamline workflow, or tighten administration with a laser-focused solution. Potential customers relate much more to SaaS as a mainstream remedy. Conversely, people view apps as somewhat removed from their urgency or degree of required specialization. Part of the image confusion is that the majority of developers design their apps for:

- Smartphone and tablet usage.

- People on the go looking to break the monotony with a game, podcast, puzzle, or shopping aid.

- Needs not directly connected to a pressing issue.

- Informal lifestyle situations, not so much step-by-step strategies in a business setting.

So, can an app create a SaaS-type pricing optimization?

Yes, but there’s some risk involved. It means creating more commitment before entry, increasing advertising expenditure, and altering the messaging emphasis. Although the app and Saas strategies are substantially different, it doesn’t mean that an app developer can’t appeal to a SaaS-type audience. (i.e., borrow from the SaaS book).

So, how can app marketers inject more commitment into their CJs from the start? The decision revolves around trading the download quantities for a better quality of user per download.

A. Business applicability is a massive retention factor.

Many apps function around SaaS-style requirements, but their owners don’t realize it. The latter is best suited to a shift in higher retention strategies that should result in higher LTV/CAC ratios. Not all app categories are alike on the retention metric. For example, messaging apps represent 5.6 times less churn than others looking at a one-year horizon. One can see why. Messaging (for B2C and B2B) is close to a business process with tremendous work usage.

Therefore, the takeaway is that the closer you are to de facto business planning, the more chance you have of subscription success. The latter ups user commitment when entering the app stores.

B. Competitive intensity

For the most part, mobile apps are in intensely competitive markets – far more than SaaS brands. Before developers look around after launch, others mimic and snap at their heels, sometimes without caring for patent protection. It’s a dog-eat-dog environment. No one entrant is establishing a price anchor, which is why users’ default positions assume “pay little or zero to try it out.” It’s the last thing a professional SaaS developer wants as a market driver. Indeed, low-value perception is a slippery slope to unacceptable ROI at the bottom of the hill. Statistics back this up with an alarming insight that 23% of mobile app developers fighting for survival, aiming for success, crash, and burn.

Therefore, the takeaway is threefold:

- Don’t follow or get caught up in a price war. It’s a signal that you don’t believe in your meaningful differences. Indeed, it looks like an admission that you may not have any. That does nothing for a sustained CJ.

- While everyone else follows price-cutters, you should heavily promote your primary benefits based on value for money. The more uniqueness you convey, the more attention you’ll attract (and that can simply emerge from not copying the herd),

- You have a chance to merge interest into conviction and thereby establish retention.

- Getting a regular subscription into the mix (ala SaaS style) gives you reserves to improve the value proposition by adding features and benefits. There’s nothing better for your ROI than adding brand stickiness and LTV.

Crucial questions to ask yourself to find the right pricing.

Customers, in the end, weigh up your value proposition (VP) against the price you charge for using your app. As strange as this sounds, what kind of VP motivates a potential consumer to download for free or $0.99? Answer – It’s safe to say, at that point, next to nothing.

At best, users are slightly opening the gate to let you show your stuff. Ultimate success hides behind waiting for someone to test it out. As stated above, SaaS marketers want to establish value upfront – before going in – to secure retention. If you’re going to play this game, pricing strategy is crucial: Again, ask yourself:

- At what price do I think I have an overvalued brand on my hand? In other words, at what point will the customer judge it to be too expensive?

- Conversely, at what price am I giving my customers a bargain?

- With my VP, can I escape the “free to download” shackles that seem to be swamping the app inducement approach?

In both (1) and (2) above, establish a short-range. Going through the above brings you to terms with your product value, unique features, and the chances of accelerating retention rates. Apps that fall into the “same old, same old” paradigm” have little chance of success.

Conclusion

Industry experts understand that 72% of smartphone users admit to deleting apps without ever using them. You don’t want more of those in your corner as a developer. Everything written in this article calls for brand visualization and transitioning to a SaaS-type subscription program ASAP.

The big lesson is that a subscription represents:

- The subscriber acknowledging the brand’s value.

- A customer commitment. Moreover, the longer the subscription contract, the higher your App’s VP rating.

From the developers’ viewpoint, re-subscribing as contracts end is vital. As a result, term commitment arrangements generally keep the app team on their toes to sustain user engagement. That’s a win-win for the business and the CJ.

ShyftUp suggests that customer communication and feedback keep you ahead of the curve with suggestions and insights from the people interfacing with the product. It feeds the stream of innovations and improvements that positively establish one-upmanship and the bottom line. Finally, you have to move past reliance on one-time acquisition fees and in-app sales if you plan on sales predictability and sustainability for your future. These last-mentioned monetization strategies don’t have the benefits of predictable, recurring revenue that subscription plans provide.

Our experience is that mobile apps are in the early stages of seeing the value in subscription models. Moreover, in 2016 Apple and Google announced subscription plan incentives that would assist pricing strategies alongside app bug erasures, new features, and added reasons to engage over time. Everything to make the subscription model look better.

To fill in gaps, talk to ShyftUp – a leading global User Acquisition Agency. They’ll help you decide on the Apple pricing strategies for your app portfolio. ShyftUp focuses on two primary services:

- App Store Optimization (ASO) – unleashing the power of organic user growth by creating boosted visibility on the app stores

- Paid User Acquisition – to help you grow your user base by converting your paid marketing budget into real users, thus revenue. ShyftUp specializes in Apple Search Ads and Google UAC channels.

What is a price optimization strategy?

It’s finding the price that establishes user retention for the longest time. It stays at least three times higher than customer acquisition costs (CAC).

How can price optimization be improved?

By not following a price-cutting policy, maximizing app value, and establishing a long term subscription contract

How much does price optimization cost?

How long is a piece of string? The question should be, what should the lifetime value/customer acquisition cost ratio be? At least 3/1, but aim for 5/1/. A proportion of 1/1 means you’re breaking even. If less, you’re losing dollars.

Customer behavior patterns: SaaS users vs. Average app users

How realistic is the scenario above?

Customer retention and CAC (Customer Acquisition Cost)

Why is user retention so vital?

What is CAC, and what’s its impact on app pricing optimization?

Be brutally honest with yourself.

Can I learn anything from SaaS pricing to improve customer retention?

So, can an app create a SaaS-type pricing optimization?

A. Business applicability is a massive retention factor.

Crucial questions to ask yourself to find the right pricing.